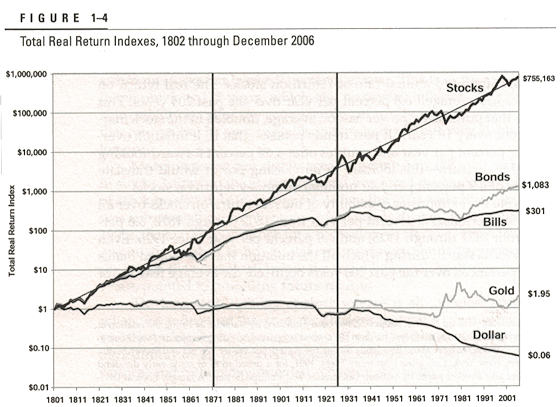

Here is a picture of the comparable performance of Stocks, Bonds, Bills, the Dollar and Gold over the last 200 years taken from Stocks For the Long Run by Dr. Jeremy Siegel, Wharton Professor of Finance.

Total Return, as Dr. Siegel defines it, "means that all returns, such as interest and dividends and capital gains, are automatically reinvested in the asset and allowed to accumulate over time." Although stocks and bonds ran along similar paths in the first period (1801-1870) while America was changing from an agrarian to an industrial economy, stocks began to pull away in the second period (1871-1925). At that time America was becoming a world economic power. But the most dramatic divergence comes in the third period (1926-2006), despite the market collapses in 1929 and 1931, the Depression, and World War II. When viewed from this perspective, even the Great Depression is no more than a small blip, and stocks far outperformed the other instruments charted here. The criteria utilized do not guarantee gains or profits, nor is past performance a guarantee of future gains or profits.

Contact Us

Disclaimers

Privacy Policy

Home

Copyright ©2024 Pacific Investment Advisory - All rights reserved. |

|